In 1988 when the Amidi Group purchased a property located at 165 University Avenue in Palo Alto, California, little did they know it would lead to a turning point in their Persian rug business down the line.

Within the next decade, the building became a shared workspace for young companies and went on to house successful companies such as Google, PayPal, and Logitech.

The building, which was located in Silicon Valley, enabled the company to meet some of the world’s most notable startups at an early stage and invest in them, often collecting equity instead of rent for the use of the space.

In 2006, these early success stories led Saeed Amidi to create the Plug and Play Tech Centre, a global innovation platform, with the aim to connect early-stage investors, startups, and the world’s largest corporations.

Today, the company is an ecosystem, which has notably brought together over 50,000 startups and over 550 world corporations. As of 2021, Plug and Play had 1,500 active portfolio investments that have raised $9 billion in venture funding.

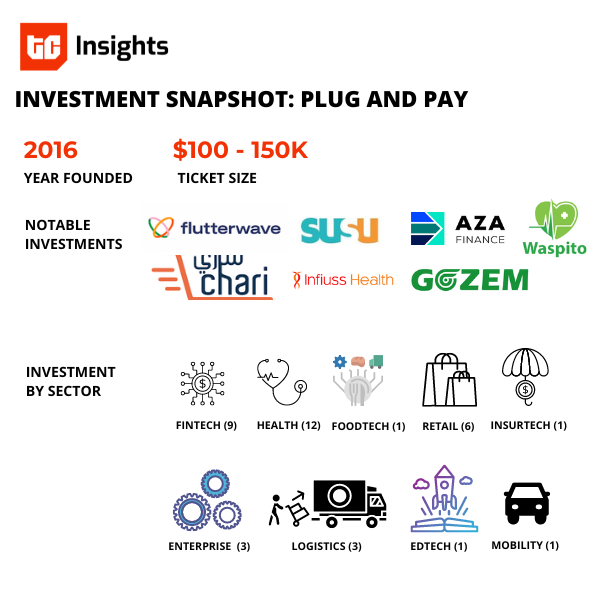

In Africa, Plug and Play is one of the most active investors. The firm did 18 deals in 2022—an average of two deals per month—investing an average of $100,000–$150,000.

In this edition of Ask an Investor, I spoke to Diego Arias, an investor at Plug and Play who invests across multiple verticals and markets in Africa.

After a two-year stint at Wikifactory, a Spanish-based hardware startup, as growth lead, Arias joined Plug and Play in January 2021 as a healthcare analyst. In September 2021, he joined the Morocco office to work on their Smart Cities programme and launch a healthcare and agritech programme. More recently, he helped set up Plug and Play’s Cairo office.

Over the course of the conversation, we discussed Plug and Play’s multifaceted approach to supporting startups and innovation on the continent.

Daniel Adeyemi: What’s Plug and Play? Is it a VC firm, an accelerator or what?

Diego Arias: Think of Plug and Play as three separate spheres—corporate innovation, acceleration, and investing—that are all interconnected. In simple terms, we’re a one-stop shop for innovation.

On the one hand, Plug and Play is a corporate innovation platform. We help connect corporate partners with startups, and we help them access and de-risk innovation by building a completely free accelerator programme for startups under the verticals that they focus on.

We work with different corporations such as the OCP group, the largest fertiliser company in Morocco, the ministry of IT, and the National Bank in Egypt. In South Africa, we work with the World Bank Group, and Habitat for Humanity, with a focus on sustainability and shelter tech.

This is how the first bucket, which is corporate innovation, connects to the accelerator aspect. I don’t like to use the accelerator word to describe us because we’re not really an accelerator. It’s different. We don’t do cohorts like Y Combinator, we don’t take equity, and we don’t take fees for this programme. We’re completely free for startups.

This gives us the flexibility to work with startups that are either more mature or looking to expand to a new market. For example, we’ve helped a Series B company to expand into Egypt, and we also help accelerate startups that have raised less than $200,000.

DA: When you say it’s completely free for startups, who pays for it?

DA: The corporations. Let me give you one of our favourite case studies: Mercedes partnered with Plug and Play in Germany to run an accelerator programme solely focused on automobile technology. One of their key focus areas was getting better voice recognition technology for their cars. We helped connect them with a startup that’s now providing that voice recognition service for them.

We work with corporations and help accelerate startups in their focus areas. And then we’re also able to invest in the best ones. That’s why the programme is free. We have the flexibility to work with multiple companies or multiple startups across different stages, but we’re not bound to promise them that we’ll invest.

On the investment side, our ticket size is flexible, depending on the stage and round size. But we’re able to move fast and then bet on the companies that we have market validation and demand from either the market or our corporate partners. We invest out of two pools: the family offices and funds under management. Our family offices do early-stage deals, and then we have specific funds like our industry-specific Future of Commerce fund or $25.5 million mobility and logistics fund.

DA: Wow, that’s a lot going on!

DA: Yeah I can imagine, but for us it’s a great way to create value across segments because in a way if you think about these three buckets, startups can come from anywhere and move across the buckets. For example, we can start working with a startup to accelerate it and then we notice them a bit too early, so we introduce them to a corporation, so they can sign up for a pilot programme to offer their services. If it converts and we think the startup has potential, we can go on to accelerate or even invest. It could also go a different way where we invest in a startup, accelerate it to a certain stage, and then introduce it to a corporation. We have endless possibilities to create value. The same approach applies in expansion across the continent where we can take companies from Morocco to Egypt to South Africa.

With our healthcare and agritech programme in Morocco, we took companies from South Africa, to Nigeria and from Kenya to Turkey.

DA: Do the different funds you have target different sectors?

DA: Yes, there are different programmes. Our Morocco and Egypt offices are focused on smart cities while South Africa is focused on sustainability, ending plastic waste and access to sustainable housing. In Egypt, we have more flexibility to do mobility or access to healthcare or financial inclusion. Of course, Plug and Play has about 48 locations globally, so there are global programmes such as the global healthcare programme. We also have an aerospace programme in Italy.

DA: What type of startups do you invest in?

DA: n Africa, we’re industry-agnostic, so we’re able to work with companies in any sector, with the most common being healthcare, fintech, retail and logistics sectors.

We’re looking for startups that are solving a problem that can scale. We ask questions such as, how big is the problem, and how much value can we provide? Is this a proven solution? Can we help scale this? What does the traction look like?

Then we look at the team and what the fundraising looks like. We don’t lead rounds, so we really collaborate with other investors. Because we’re very active, we did about 20 deals last year; some of them were not announced.

Another thing we really look into is providing value and collaborating with other co-investors, and then seeing how our network can be used to support these companies. For me, one of the most important things is to look into building a portfolio.

For example, when investing in a company that does KYC, we’re also going to look for fintech companies that require KYC services and can integrate with this portfolio company. It’s a way of double-betting and vetting.

DA: You don’t lead rounds—why?

DA: When I say we don’t lead rounds, I’m mostly referring to establishing the investment terms and investing the larger volume.

Ultimately, we are a very high-volume fund. In Africa, we’re among the most active investors. Globally, we make between 200–300 deals every year. We don’t have the capability to lead rounds with that deal volume, unless you’re like Tiger Global which outsources its due diligence to Bain. We’re able to invest across multiple industries and geographies, and then follow on with our growth funds, so that we can then double down on the winners and help them with corporate partnerships.

If I get a deal that is promising and is in a market that we’ve never invested in, we tend to rally around to get other investors to invest.

When I led our first investment in Cameroon in a startup called Waspito, we began speaking when the round was about 40% filled up and I helped in sharing with other investors. When the round reached 75% completion, we invested. It ended up being an oversubscribed round!

DA: How long does it take to decide on whether to invest in a startup?

DA: It depends on the scenario. In a best-case scenario, where we love the idea and the team, and the round is about 75% complete with a familiar lead investor, we can jump from the first call to commitment, excluding legal due diligence, in three to four weeks. The fastest I’ve done is two days, which was a rare outlier.

But in another scenario, if we meet a startup and really like them, we can help connect them with other investors to help drive a bit of excitement and help them expand to a new market. All of this can take about two or three months. This is a medium-case scenario.

On average, I would say we take four to six weeks for due diligence.

DA: You mentioned helping companies to expand into new markets. What’s the catch?

DA: We don’t get a cut. We’re ecosystem builders and this ties directly to our work of building a stronger startup ecosystem. We work with corporations to help them access startups. The stronger the startup ecosystem is, wherever we work, the stronger our value offering is. So we’re actually de-risking our own future by helping startups expand to new places. When we opened in Morocco, the country was receiving less than $15 million a year in VC investment in 2020. The following year the amount increased to $30 million.

The fact that the amount doubled, which was mostly driven by one of our portfolio companies that raised a lot of this money, implies that we’re building a stronger offering and helping the ecosystem develop.

This company that has attracted international investment is generating visibility for other companies that will be coming up one or two years later down the line. The head of product at that company can later leave and found another startup, which will also attract funding.

So that’s why we’re able to work with startups at no cost. I know it sounds like there’s a hidden trick, but there’s no trick because, ultimately, we work with corporations to help startups.

DA: What are some red flags you look out for?

DA: We ask ourselves, does this opportunity have the potential to scale? Can this provide a 10–20x return? We see great entrepreneurs working on things that make a lot of sense but they just don’t provide a potential case for a venture-scale return. A 2x return is not enough. We’re not private equity, we’re not investing $100 million; we’re investing $100,000

We have to see a clear path to exit and how it can fit within our portfolio.

We also value straightforward communication. For example, I remember speaking with this startup about whom we were on the fence about whether we’d invest or not because we were still doing due diligence. Then they told another VC that we were committed, which wasn’t the truth. That was a turn-off. We don’t invest in hardware or biotech—projects that require many clinical trials.

The startup also has to be stable financially. We don’t want to invest in companies that raised about $500,000 and they have about a $100,000 burn rate; it makes no sense.

We need to see that everything checks out from a financial perspective. Reasonable burn rate, clear cap table, no heavy debt, and no over-dilution.