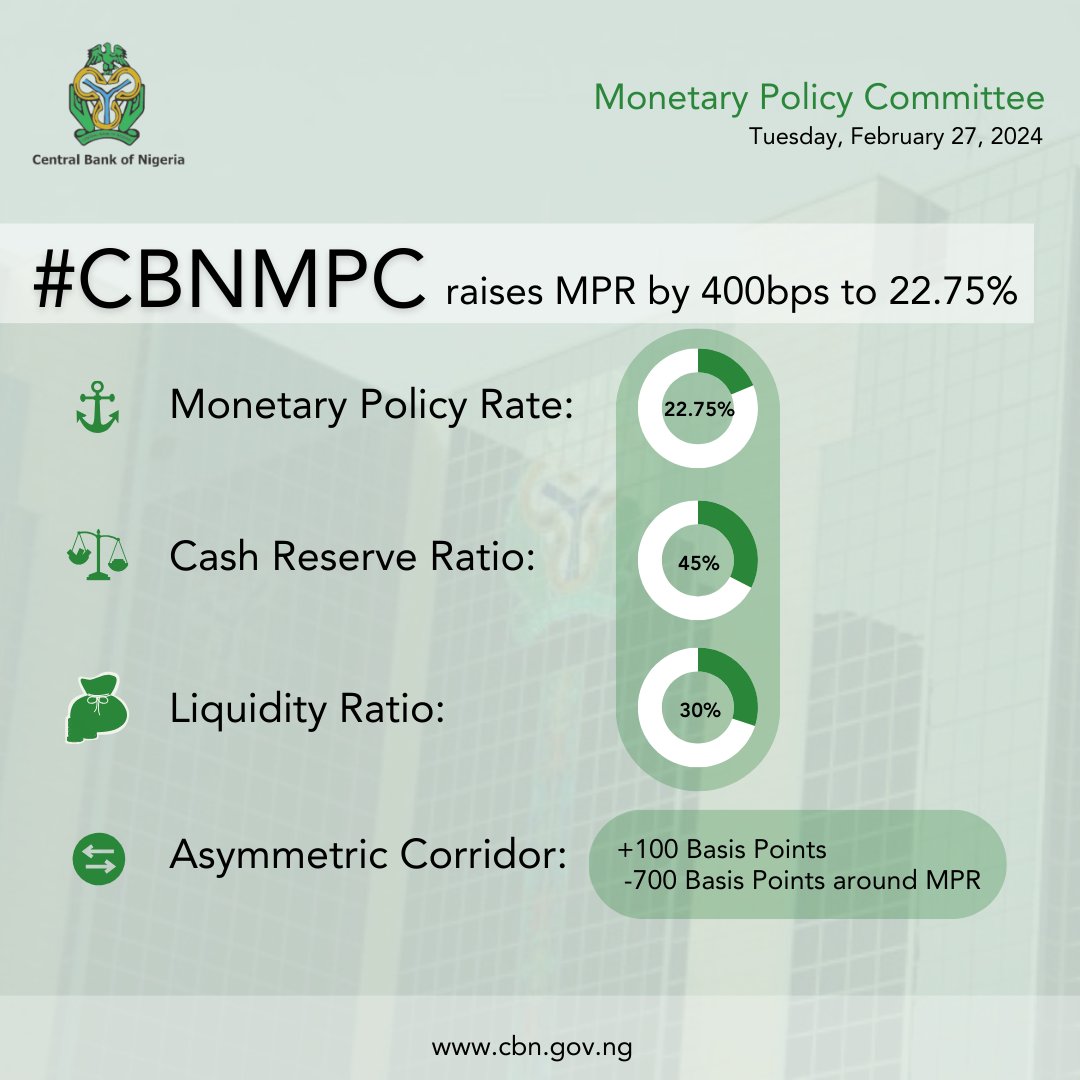

Nigeria’s Central Bank has raised the benchmark lending rate by 400 basis points to 22.75%, from 18.75% in the most aggressive push to contain inflation. Olayemi Cardoso, the CBN governor, announced this today after the bank’s Monetary Policy Committee (MPC) meeting that began Monday.

The rate meeting, the first under Olayemi Cardoso, had been viewed by analysts as a test of the bank’s seriousness in curbing worsening inflation.

At least five policy experts surveyed by TechCabal expected a 200 basis point hike today. Cardoso would be secretly hoping that rate decisions translate to the economy. A gap already exists between the central bank’s policy rate, yields on the short-dated paper it sells at auction and what is offered on government debt.

Explaining the motive for the hawkish stance, Cardoso said MPC members were concerned about the persistent rise in the level of inflation and emphasized the commitment to reverse the trend.

“Previous policy rate hikes have slowed the rise in inflationary pressure but not to a desirable extent,” he said. “Members concluded that inflation could pose more regulatory challenges in the near and medium term if not effectively anchored.” According to him, non-monetary factors were driving inflation.

Experts told TechCabal that Nigeria’s rising inflation can’t only be solved by raising MPR. “Our current cost of living issues are being propelled by structural drivers and not by transient supply and demand issues,” Ikemesit Effiong, a partner at SBM Intelligence said. Understanding the motive for rate cuts or increases by the MPC committee would offer more insights into Cardoso’s plans for the economy, another analyst Kalu Aja said. It would be important to know if it’s a “unanimous decision or not,” Aja added.

President Bola Tinubu’s reforms have been met with pockets of protests across the country, with consumers lamenting that their spending power has been eroded. Inflation is at a nearly three-decade high at 29.90, six months after Cardoso’s rise to head the CBN.

Tinubu had appointed Cardoso —his long-time associate— to man the Central Bank last September after his predecessor, Godwin Emefiele did a poor job of controlling inflation which had attained an 18-year high mark in a space of six years. Emefiele’s time as governor was notable for expanding loans to the federal government, CBN-funded agricultural schemes, and artificially pegged exchange rates.

Cardoso, who previously dismissed the impact of monetary policy meetings, is under pressure to deliver stability. Analysts will observe how impactful his reforms in stabilising the naira will be after the CBN’s recent reforms on the Bureau De Change operators.