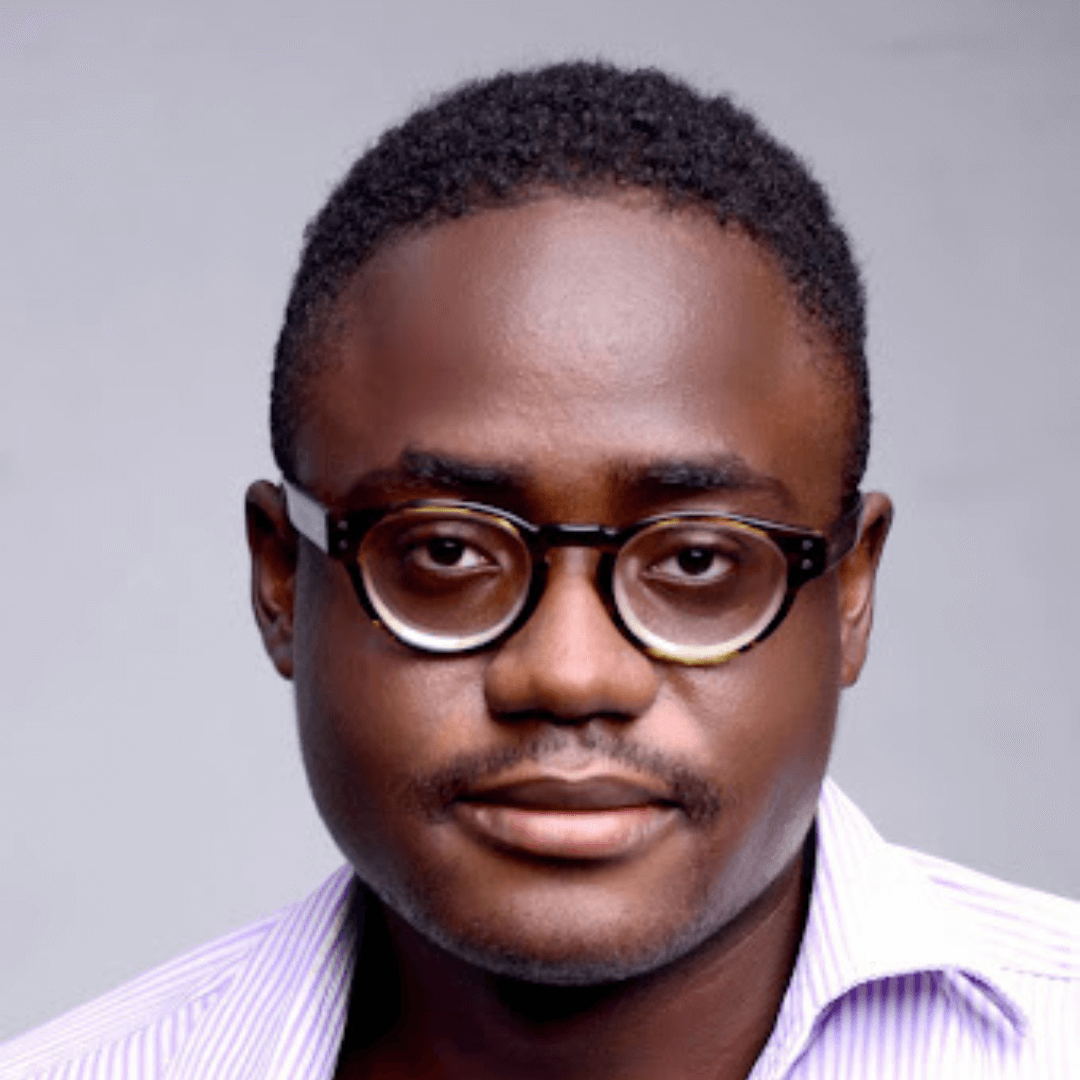

Yemi Cardoso, Nigeria’s Central Bank Governor, will tomorrow share the bank’s policy direction and economic outlook for the first time since his Senate confirmation. After two postponements of critical rates meetings, Cardoso will speak at the Chartered Institute of Bankers annual dinner.

The Central Bank of Nigeria is mandated by law to hold monetary policy committee (MPC) meetings every two months to set the lending rate for Africa’s biggest economy. Still, it has failed to do so since July.

“Tomorrow’s meeting may boost market confidence as uncertainties about CBN’s actions would reduce,” Mayowa Badejo, a partner at 213 Capital, an investment and risk advisory firm, told TechCabal. He added that the dinner would help Cardoso interact with bankers and share his plan regarding monetary policy with them while seeking their cooperation.

Cardoso’s silence and lack of urgency comes as Nigeria battles with rising inflation, which hit an 18-year high of 27% in October. KPMG, a financial and business advisory firm, predicts that Nigeria’s headline inflation will hit 30% by December 2023. Analysts anticipated a rise in interest rates this month to help slow down inflation and protect banks from losing capital as inflation continues to rise. However, the lack of communication, which might continue until 2024, has now created a vacuum.

Aside from failing to curb inflation, the failure to host an MPC meeting in four months and the lack of communication from Cardoso since his appointment are also dampening foreign investor confidence. His two-month silence comes as the naira trades at some of its lowest levels amid a dollar shortage.

Under the acting CBN governor, Folashodun Shonubi, the bank raised interest rates, but Cardoso has yet to make any decisions. TechCabal reported that CBN postponed this month’s MPC meeting scheduled for Monday and Tuesday without giving a reason. The Central Bank’s decision to unveil an economic outlook for 2024, shows that Cardoso is finally ready to talk and share his ideas on how inflation could possibly be curbed.

NBS data showed food inflation hit 31.5% in October. The prices of bread and cereals, oil and fat, potatoes, yam and other tubers, fish, fruit, meat, vegetables, milk, cheese, and eggs soared as cash-strapped Nigerians struggled to buy major essentials.