A new player is entering into the mobile payment space in Nigeria. Launched today by the Nigeria Interbank Settlement System (NIBSS), it’s been named mCash.

Today is the official press launch of the new payment platform #mCash. Go to https://t.co/vnfYeTMBcC pic.twitter.com/22vGTqVywh

— NIBSS PLC (@NIBSSPLC) November 3, 2016

mCash (short for microCash) is a mobile payment system for making low-value retail payments. It was designed to extend e-payment options to low-income buyers and sellers who typically deal in cash.

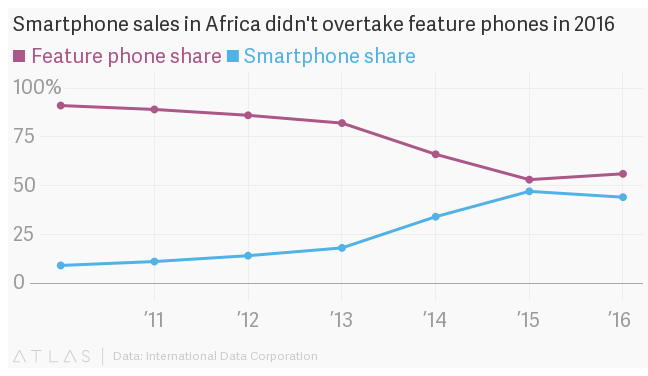

NIBSS entered into a partnership with all Nigerian financial institutions and the four major telecom networks (Airtel, Etisalat, Globacom and MTN) for mCash. They did this so that any user, no matter their bank or network provider, can use mCash with a single 402 shortcode. mCash will leverage on the NIBSS Instant Payments infrastructure (NIP) for immediate fund delivery to merchant accounts and it will be based on USSD technology.

I think this thing is wonderful. It will use the Bank Verification Number we all suffered to get; ensuring ease of use and payment. The NIBSS also went a step further to insure all transactions below N50,000 and promises users less than 6-hour refunds in cases of errors and frauds.

So how does this thing work?

Merchants interested in using the platform can walk into any financial institution and get their seller code, a unique 8-digit number, for free. The code can then be displayed at the point of sale to enable customers make payments.

For users, making payments with mCash is done in a simple 5-step process.

All you need to do is input the 402 short code followed by the 8-digit seller code and the transaction amount.

You will then be prompted to select your preferred bank account, enter a pre-saved PIN and voila, you receive payment confirmation. The process is all instant, debiting buyers and crediting sellers immediately.

For transactions below N10,000, buyers will be charged N20 per payment. Sellers pay N50 while buyers are charged N20 for transactions above N10,000. Unfortunately, because mCash is a micro payment platform, transactions are set at the N50,000 limit.

MD of NIBSS, Ade Shonubi, speaking at the launch said mCash is a game-changer as it brings a much sought-after collaboration among telcos.

We already know that Nigeria is the most “mobilized” country in the world so mCash will have no troubles gaining users. The fact that it eliminates the need for POS machines, cards or even a data connection means it will be especially useful for low-income earners. Unbanked Nigerians get no love though, mCash works with your BVN after all.