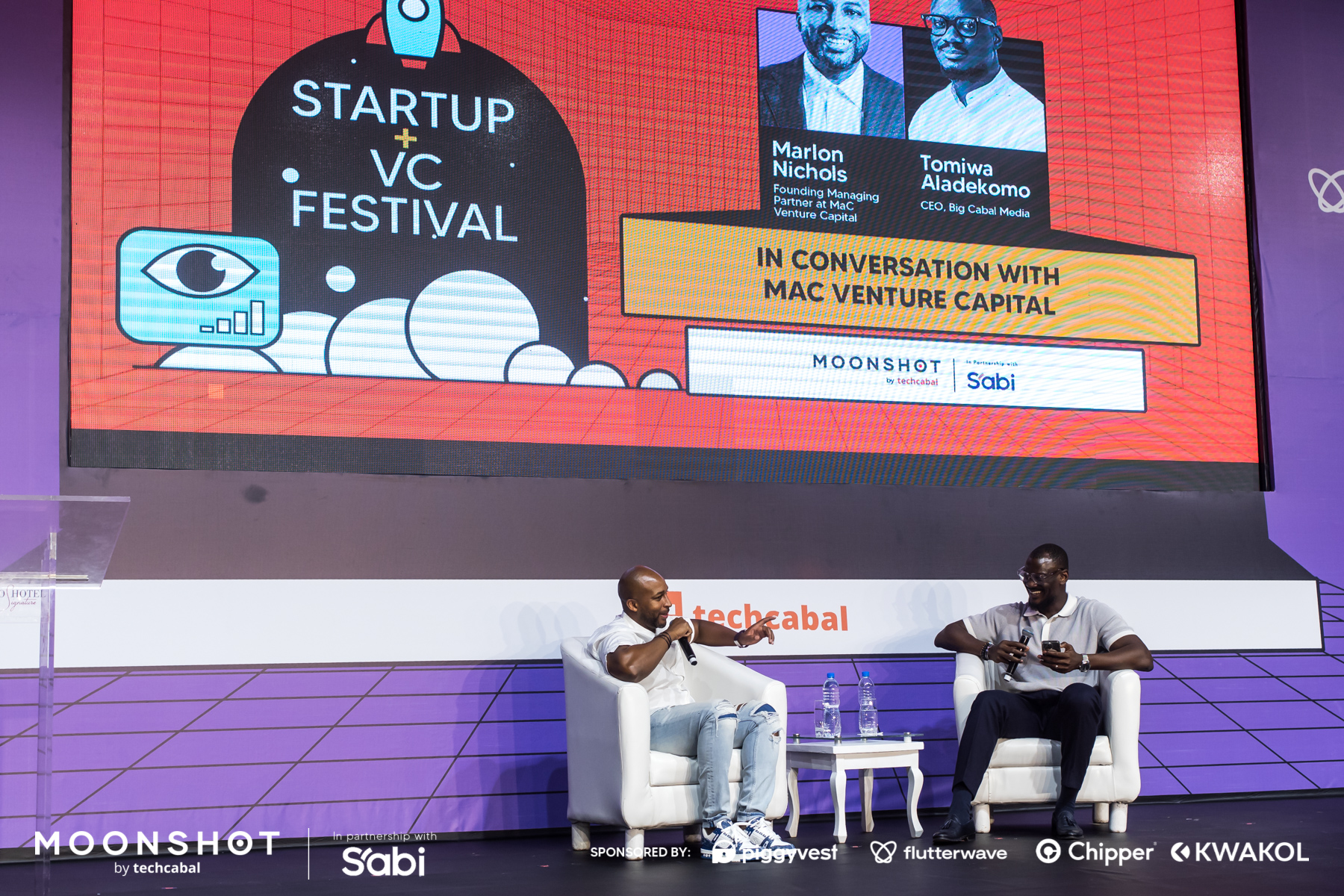

In a fireside chat at the Moonshot by TechCabal Conference, Marlon Nichols, a managing general partner at MaC Venture Capital, a firm with over $20 million invested in Africa, shares his investment thesis.

Funding for Africa’s tech ecosystem has been on a downward spiral since the start of the year as interest rates rise globally and investors continue to make safer bets. However, some venture capital firms are still increasing their footprint on the continent. One such VC firm is MaC Venture Capital, a sector-agnostic firm with $500 million in assets under management and an African portfolio with more than 10 startups.

MaC Venture Capital invests up to $3 million in seed-stage companies as its initial entry ticket size, in exchange for 10–15% ownership in the companies on a fully diluted basis. “For us, seed means that you have a viable product that you have recently taken to market, or that you’re about to take to market,” Nichols said in a fireside chat with Tomiwa Aladekomo, CEO of Big Cabal Media, at the recently-held Moonshot by TechCabal conference

Some of the African startups that are in the firm’s portfolio include Big Cabal Media, the parent company of TechCabal; Spleet, a prop-tech startup; and Prembly, a digital security startup. Nichols shared that the firm’s investment thesis on the continent is centred on finding the challenges “stopping people from living their best lives”.

“We want to make money for our investors,” Nichols said, “so we look for really big problems in big markets that are being tackled by very smart people that have a fit with the market, the company, and the challenge.”

With 197 startups in their portfolio, Nichols said MaC Venture Capital decided to invest in Africa after being introduced to Ajua, a Kenyan customer experience startup. “What happens is [that] you start to build this network of people and you learn about more exciting opportunities, so you just start writing more cheques.”

Due diligence and corporate governance have been running themes in Africa’s tech ecosystem this year as several startups have closed due to bad corporate governance. On due diligence, Nichols said that the firm relies on angel investors and founders in their portfolio for advice and validation of the pitches they receive in markets where they do not have enough context.

Watch the full video of the fireside chat with Marlon Nichols and Tomiwa Aladekomo on YouTube.