It’s a bit ironic that while women run 40% of Africa’s small and medium-sized enterprises (SMEs), female single founders received less than 1% of funding from Venture capital (VC) firms in 2021.

Compared to the fact that male single and all-male founding teams received 84% of the funding from VCs in 2021, the handwriting on the wall is clear: female-led startups in Africa remain critically underrepresented and underfunded.

Adesuwa Okunbo Rhodes has a simple solution to this. “Women don’t need more seats at the table, we need to create our tables,” she said over a call.

The tables she’s referring to are the investment firms — both VC and private equity (PE)—that fund businesses. The disparity in female-funded startups is fuelled by the fact that most investment firms are also led or owned by males.

So Rhodes, who has 13 years of investment banking experience under her belt, created her own table by starting a PE firm in 2019.

Born in Lagos, Rhodes moved to the UK to continue schooling in her teens and then went on to graduate from the University of Bristol in England.

Her investment career started at Lehman Brothers in June 2008, but that journey was cut short by the 2008 financial crisis that took place four months later, which led to the eventual collapse of the 158-year-old Lehman Brothers.

After Lehman Brothers, she started a 4-month internship at JP Morgan. When the internship ended, she went to TLG Capital for a short period, and then went back to JP Morgan for a full-time job where she worked on acquisitions and leveraged finance deals worth about $5.6 billion for almost 4 years.

Her desire to invest in Africa was sparked in 2011 during her 5 months at TLG Capital, a private equity firm that invests across Africa. Rhodes worked at TLG Capital briefly after her initial four months internship with JP Morgan and before being retained for a full-time position.

“At TLG Capital, we did a number of investments across Anglophone Africa but the most important one I would say is one we did in Uganda,” Rhodes recalls.

The firm made an investment in a local manufacturer of generic anti-malaria and antiretroviral drugs, which brought attractive returns and empowered the local manufacturer to become self-sufficient enough to export its products to other countries that didn’t have drugs.

“After that experience, I thought, ‘I want to do something like this back in Nigeria but I didn’t know how I was going to go about it,’” Rhodes said.

In 2014, while at JPMorgan, Rhodes was approached by Syntaxis Capital, a European private equity firm that had about $300 million dollars under management, to help build out their African business.

The opportunity afforded her the chance to fulfil her dream of returning to Africa to invest. Over the course of almost 5 years on the job, she saw firsthand the challenges women faced to raise capital for their businesses.

“I looked around and I saw that women were struggling to fundraise,” Rhodes said. “There were no other women leading or running their own funds. And I thought, ‘Well, you can’t be what you can’t see.’” She realized that in order to make a business case for investing in people like her, women needed examples of other women who had successfully run and led their own funds.

She began to corral her funds—cashing in her JP Morgan bonuses, exiting her investments—and in July 2019, she bought the African arm of Syntaxis Capital, rebranding it Aruwa Capital.

The name Aruwa, which is a wordplay on her name, also means “we are in prosperity” in her native Edo language. Rhodes believes Aruwa speaks positively about the future about the impact her firm is going to have on the continent.

Daniel Adeyemi: What were the early days of Aruwa Capital like?

Adesuwa Okunbo Rhodes: From the onset, I decided that Aruwa will have a very specific gender lens focus, where we would invest in businesses that are past the idea stage. Businesses that have an existing route to market and have existing demand for their product or service, but require that capital to scale up to the next stage.

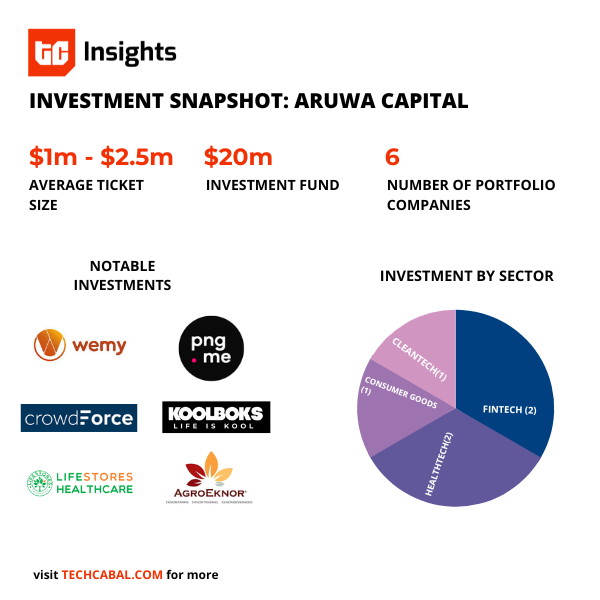

These are businesses that need anywhere between $500,000 to $2.5 million dollars investment. That’s our ticket size.

What I mean by a gender lens focus is that these businesses are either founded or co-founded or led by women or gender diverse teams, or these businesses produce goods or services that positively impact women.

We see the female economy as a $15 trillion market and women are making 80% of consumer spending decisions. So as a woman that’s allocating capital and investing, I’m best placed to invest in the best businesses that are providing solutions to problems that I’m facing as a woman.

We launched a $20 million fund to do that. In October 2019, I was able to start the fund with some friends and family money and we invested in our first deal, a deal called Wemy Industries, which is a local manufacturer of personal hygiene goods. Think baby diapers, baby wipes, we have the only adult diaper in West Africa. That business is doing very well since we’ve invested in it. We’ve managed to bring on private equity funds, the same funds that told us the deal was too small when we were looking at it back in October 2019. The second investment was in a company called LifeStores Pharmacy, a health tech business, in April 2021. We’ve also invested in Png.me, a business to business (B2B) fintech company co-founded by a woman in October, 2021.

The following month, we made our fourth investment in a company called AgroEknor, an exporter of superfoods that uses technology to control the value chain from end to end. We’ve also invested in fintech company Crowdforce, leading the round with $1 million, and Koolboks.

We’ve now done 6 investments and had to increase the size of our fund to $25 million, just based on the interest that we’ve seen. Our anchor in the fund is Visa Foundation. And we’re looking to close the fund before the end of the second quarter this year.

DA: What do you look for in the companies you invest in?

AOR: We’re not a typical VC firm. We’re not doing seed or pre-seed. We’re doing what I call pre-private equity. These are businesses that have already proven the business model. They already have an existing market, but they’re too small for the private equity fund. And that’s really where the majority of activity is happening. They also have to be companies in one of these four sector verticals: health care, fintech, renewable energy, or essential consumer goods.

We say to our investors that that’s the sweet spot, because these businesses are already de-risked to some extent, but they need investors like us to institutionalize them by providing them with growth capital. They need investors like us to provide them with the right corporate governance and structure to then attract larger private equity funds later on.

I think a bigger objective for Aruwa is that we want to be an example of the magic that happens when women are empowered as capital allocators. We have less than 10 private equity funds in the whole of Africa run by women and possibly even fewer funds run by African women. So I’m very passionate about telling that story because as you invest in more women as capital allocators, there’s a natural trickle-down effect to women in our portfolio.

The increased gender diversity that happens in our portfolio enhances the profitability of our businesses and enhances the returns of our fund. We’ve now seen so much research from Harvard

I’m sure you saw the statistics: less than 1% of the VC funding last year went to women. I see that as a huge arbitrage opportunity. We’re investing where no one else is looking. And we can be very selective and cherry-pick the best investments that help us to enhance and maximize returns for our investors, but also contribute very positively to society by increasing jobs and empowering women.

We’re very excited about really pioneering the space of early-stage equity growth and gender lens investing.

DA: What has been your experience investing in women-led/focused businesses?

AOR: I think there’s definitely still a need for education. We’re typically investing in businesses that have already proven themselves. They have a diverse trajectory. So giving up equities and valuation is always a conversation.

Before we became well known in the market, in those earlier days, people were like, “Who is Aruwa?” We had to try to convince people of the value that we can bring.

We’ve had to build our reputation and trust with companies. Now that we’ve done 6 investments and have examples, it’s a little bit easier to be able to convince entrepreneurs to give their equity to us because it’s a marriage.

It’s a 5-year marriage, or at least a 2- or 3-year marriage of building up the trust of entrepreneurs because we always say that we’re not just coming with money. We’re providing more than just the money. We’re a partner that would help you scale up your business.

At the beginning, when we were a new name, it took a little bit longer, but I think now with examples of what we’ve done for other companies, it makes each conversation a lot easier.

DA: Investing in 6 companies over the span of 2 years sounds slow and deliberate. Tell me about this approach?

AOR: We don’t write deals within 24 to 48 hours. We take our time. Our process can take anywhere between 3–6 months. We’re not a spray and pray VC model.

This is our first fund, so the returns of this fund are going to determine how the assets under management and return on investment are built for the next 30 to 50 years. So we’re very intentional about the deals that we’re doing and we take our time to do the due diligence required. For us, it was record-breaking to do 5 deals in one year in the private equity world, but in the VC world, obviously, you’re doing like 20 to 30 deals in a year, so it’s a little bit different. For us, it’s a good year if we’re able to do 3 to 4 deals.

We’re not cutting corners or shortcutting the process. It’s just different because of the stage that we’re investing in. There’s nothing wrong with the VC model. It’s just a different approach because in VC deals you can base it on your knowledge of the market and a gut feel of the founders.

DA: How do these companies find you?

AOR: We’ve been inundated with requests since July 2019. We’ve got over a billion dollars worth of deals in our inbox. There’s a lot of demand for the capital that we’re providing. So people reach out to me on LinkedIn or via our email address (info@aruwacapital.com) or my email address. I don’t know how people get my email, but they also reach out to me on my email.

DA: What are some red flags you look out for when investing?

AOR: We want to invest in a team with a bench. We don’t like to invest in businesses that don’t have a strong management team. We’re very conscious of making sure that the CEO has the right support across all the different layers of the business: finance, operations, sales, etc.

Another thing we look for is ways to make sure that the team has skin in the game. So I think it’s a red flag if the founder or the team haven’t invested any money, even if it’s a friend or family round. If they quit their job or give up salary positions, that also counts. You know when people act like that, it shows their seriousness. It’s not just money that counts as skin in the game. Time and commitment also count.

I don’t like it when founders don’t know their numbers—revenues, margins. You should be able to talk intelligently about your numbers because it just shows that you know your business inside out.

DA: You said you invest in teams. Do you invest in single founders?

AOR: Yeah, we could invest in a single founder, just make sure you have a team around you that can support and you should be able to delegate. I’m a single founder. I don’t discriminate against single founders.

DA: Are there any deals you’ve missed out on?

AOR: Yeah, they definitely exist. When you spend 4 years fundraising you miss out on a lot of deals. For example, investing in Trade Depot was a deal that I wished I did but at the time, we didn’t have capital and we missed out on them.

I’m someone who believes that everything happens for a reason. So I don’t really have many regrets. If God didn’t want it to happen, it didn’t happen for reasons. We just keep it moving.

DA: What trends are you seeing in the market?

AOR: There’s a lot of hype and excitement right now, but in my personal opinion there won’t be as many winners as many people think. Yes, the market is large, unsaturated, and we still have a lot of opportunities, but you can’t have 8 players in the same vertical chasing the same market. There are going to be a few winners.

For us, our focus is essential goods and services. So businesses that are providing essential goods such as health care, financial services, renewable energy and access to power, and essential consumer goods. We think that with an election year coming up and with a lot of macroeconomic instability there should be a focus on the goods and services that people always need.

So essentials, I think that’s something that over the next 10, 20, or 30 years, as we have a more rapidly growing urban African population, it’s not going to be a fad. And I think we have some fads that are happening in the market right now. A focus on essential goods and services is a good strategy for any investor to have in this kind of market.

In addition, note that it’s a seller’s market right now. So be aware of the hype. If the valuation doesn’t make sense, don’t do the deal. We have to be very selective and intentional to create our own deals.