2010 was a watershed moment in football. For the first time, the World Cup was hosted by an African country. 3.2 billion people watched the matches from their homes while 3.18 million fans attended the matches live in South Africa—Zach George was one of them.

George, who was born in Oman, had spent the past 5 years on Wall Street as an investment banker at Barclays Bank and Lehman Brothers. He was in South Africa looking for a new adventure.

“I moved to South Africa in 2010 to watch the World Cup. I also kept an eye out for opportunities to run an accelerator program because, at the time, there were no real accelerators in Africa,” George said.

While Spain went on to lift the 2010 World Cup, George spotted an opportunity to do something different on the African continent. He started his journey as a Specialist Financial Advisor at Old Mutual, then led operations at U-Start, a global boutique investment advisory firm, before a brief stint as Programme Director, Barclays Tech Lab Africa.

In 2017, he co-founded Startupbootcamp, the first and largest multi-corporate-backed tech venture accelerator on the African continent.

“It was quite a challenging task because, at the time, none of these large corporations—banks and telcos—had much interest in working with startups. It was a difficult task convincing them to put money into accelerator programmes not in exchange for equity, but to do proof of concept and pilots with these fintech, health-tech, and logistics-tech companies.”

Fortunately, George and the Startupbootcamp team were able to pull it off. “From 2017 to 2019, we saw the number of startups increase across Africa. We eventually settled on 10 companies per cohort. Notably, in the 2018 cohort, one of our top companies was Kuda Bank, which is now worth about $500 million. When they came to our programme we invested $20,000 for an 8% stake, which was a good deal at that time.”

In 2020, sensing that the African ecosystem was mature, George decided to move on from building accelerators in Africa to setting up a fund that could invest in startups and graduates of world-class accelerators.

“It started with the question of, where do you go for your first proper institutional round of funding, if you’re looking for seed funding as a startup?”

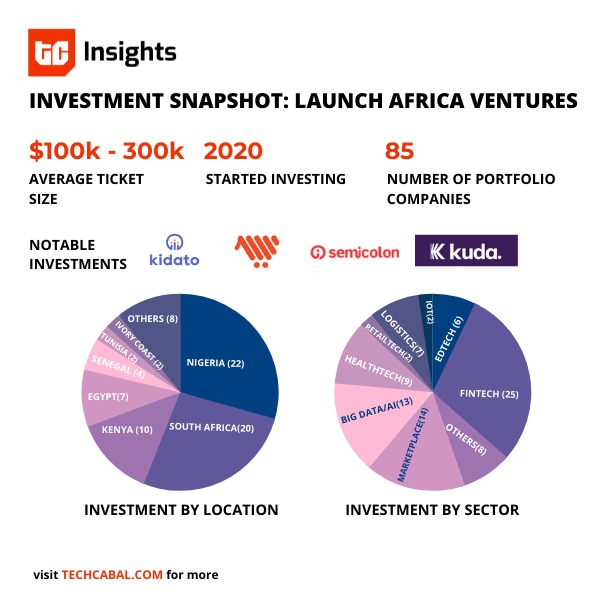

This question birthed Launch Africa Ventures, a $30 million pan-African fund that has invested in 85 companies in 17 African countries. Our conversation started off with a look at George’s career choice.

Daniel Adeyemi: Your first degree was in engineering and since then you’ve moved on to finance. Why?

Zach George: Engineering is a great base degree because you learn about the fundamentals of logic and analysis, but engineering, most times, is not a forward-facing job. I’m the kind of person that enjoys being in front of people doing presentations; this explains why I pivoted to jobs like investment banking, management consulting, or other roles where you have a lot of client exposure. So that was a reason I moved out of engineering.

I think the skills you learn as an engineer are useful in the investment banking space. If you look at most investment banks, they hire engineers because their quantitative skills are great. They really understand algorithms and logic.

Engineering is helpful inorder to understand the fundamentals of physics, economics, logic, and the flow of information. But being able to build a product is not enough; you have to be able to monetise it and make a business out of it. And that’s why the perfect combination, if you ask me, is to get an undergrad degree in engineering, like computer science, electrical, or mechanical engineering, and then go and get an MBA. You learn how to monetise your product from the business perspective, and that’s something I was fortunate to be able to do.

Most smart engineers that get into business are eventually forward-facing—think of Bill Gates or Elon Musk.

Now, I don’t encourage everyone to become an investment banker; I’m just saying that if you’ve spent a few years as a banker or management consultant at McKinsey or BCG, you really understand the basics of leadership. If you’re an entrepreneur, you have to be a leader. You need to be able to manage a team and clients, HR, internal processes, and partnerships. It’s not easy so you need to have a pretty solid degree in business organisational behaviour, decision analysis, and risk analysis, and that’s where a combination of engineering and businesses is super important.

DA: What was it like leaving Wall Street to invest in African startups?

ZG: Venture capital is very similar to investment banking. In investment banking you’re investing in listed companies while in venture capital you’re dealing with unlisted companies. I found that the skills I learned in investment banking can be applied to startups. For instance, while in investment banking, you do a lot of analysis around profitability ratios, revenue growth ratios and leverage margins, in the startup world you analyse a different set of metrics. For startups, unit economics are a lot more important than balance sheet numbers. In unit economics you’re looking at the lifetime value of a customer or the cost of acquiring a customer. Here it’s not just your EBITDA margins, but how your EBITDA margins change over a period of time. You look at growth versus churn, you look at your virality coefficient, which is basically about how many other customers are referred from customers onboarded. Unlike in investment banking, startups don’t have much data, so the ability to work with small sets of data is something that VCs really need to get.

DA: What is your ticket size? What do you look for in startups you invest in?

ZG: On average we invest between $100,000–$300,000 in a company. The typical sort of traction we need to see in companies is, they must be doing at least $25,000 in monthly recurring revenue (MRR). So if you’re a startup with just an idea and you’re just doing $5,000 in revenue a month, we’re not interested. We do make exceptions if your intellectual property is really good, or you’re in a very niche market, but, generally speaking, at least $25,000 in monthly recurring revenue.

Typically, you should have a business-to-business (B2B) business model, so you should be working either with banks, insurers, telcos, or retailers. Business-to-consumer (B2C) is very tough to scale at the early stage. And, typically, we can value a company anywhere between 5–10 times their annual recurring revenue. In certain cases, we can do more than 10 times revenue as a valuation benchmark. We invest mostly through SAFEs—Simple agreements for future equity. We don’t do convertible notes or equity unless there’s no other option. On a lot of these deals, we get our Limited Partners (LPs) to co-invest with us. We’ve got more than 150 LPs in our fund and they can write small cheques of $25,000 to $3 million. The fact that our LPS can invest alongside gives us a lot more leverage than just us having our own capital to invest.

DA: Why the preference for investing through SAFEs?

ZG:

Also, the duration of our fund is only 7 years so the reason why we can do that is because a lot of our exits come from secondaries. So when these companies are raising future rounds of funding, and there’s more capital coming in from institutional investors and series A and Series B, we will typically sell a small portion of our stake so we can get our capital back through secondaries. We don’t have to wait until an IPO or an Mergers & Acquisitions event to realise money.

DA: You’ve shared what you looked for in startups in terms of performance. Are there other attributes you look out for in founders or startups before investing?

ZG: We look for strong founders. Repeat founders are rare to find, but repeat founders, if we get them, are good because at least they have experience of doing something similar in the past, and, often, failing is not a negative thing. Failing means that at least you’ve learnt something from your past experience that prepares you for the future. We look for founders that have the confidence and know the industry really well—so founders that know their market, and understand margins and competitive pricing. Founders that have very good relationships with big corporations are important. So, if you’re in Nigeria, for example, and you’re a fintech, we’d like to know founders who have relationships with all the big banks and possibly the regulator, the Central Bank of Nigeria. We don’t invest in founders that talk a lot and are super arrogant. There are plenty of founders like that.

We look for a strong product-market fit. We typically talk to 2 or 3 of the company’s leading clients, so we always cross reference productions we do to clients.

We look at the total addressable market and the track record. Also, in our case, because we are a big pan-African fund we look for synergies and linkages within our portfolio. We really need to see how our portfolio companies can benefit. For example, a payments company, an insurance company, or a logistics company. The presence of synergies within our portfolio makes the investment case even more lucrative from our side.

DA: You’ve invested in almost 90 startups within 18 months, that’s faster than most VC firms. Why?

ZG: I think we move that fast because when you’re at the seed stage, and you’re raising like a million dollars in the seed round, you don’t have 6 months to wait for VCs to make a decision.

The legal and tech due diligence (DD), to a large extent, are taken away because the companies come through an accelerator, so the tech is usually with AWS and Google. The legalities are sorted because the IPs are in Delaware or the UK. So we spend most of our time on market analysis, examining the founders, doing human due diligence, for lack of a better word.

You look at the team and look at the product, you make a few calls with the clients and you look at the unit economics. We look at the LTV to CAC multiples, we look at the partnerships that they have with corporations, especially proof of concepts and pilots. We speak to some of their clients and consumers and that’s it. If you’re spending more than 6 to 8 weeks in DD for a pre-seed company, it’s inefficient. Once you get to Series A then you do a lot more DD.

Prior to us, there weren’t really specific specialist seed funds for Africa. Nowadays there are funds like us and there’s Future Africa. When we started the fund in September 2020, we set out to raise $15 million. And then midway through last year, we realised that there’s just way too much demand for capital and also way too much interest from Limited Partners to get involved much earlier. So we increased our fund size to $30 million.

So far we’ve invested just under $18 million dollars. We can invest a further sort of 5 to $6 million over the next 5 months and our fund will be fully invested by May, June. Then over the next five years, we’ll just be harvesting these companies—looking for exits, portfolio synergies and partnerships. And in parallel by early next year, we will raise a much bigger fund which would be focused on seed, series A and Series B. That fund size will be targeting between $250-300 million. Our goal is to become the sequoia of Africa.

DA: I noticed you have a small team and a large number of advisers. Tell me about your team structure?

ZG: We’re a very small team of 8 full-time people. So we have advisors because we have many portfolio companies. It’s important to note that the advisors don’t work for us, they work for our portfolio companies. These advisors are basically people that are experts in a product or a sector or region. For example, it could be a Nigerian fintech expert or an East Africa logistics expert. That person will directly advise our portfolio companies, and their compensation will either be some sort of a consulting revenue from the startup or what’s more common is they get advisory equity in the portfolio company, so we are able to leverage their expertise.

DA: How do you spend your time? What does a typical day look like?

ZG: It’s so many different things. First we get lots of inbound interest from founders, our team is constantly looking at founders and companies to evaluate so we do lots of initial calls with founders. I’m also constantly talking to my current LPs about helping portfolio companies or new investment opportunities and to new potential LPs.

Our current portfolio companies also always have requests related to hiring, partnering with other tech companies or expanding to different markets. We have 85 companies and over 150 investors, so there’s a lot to do.

DA: What are some key trends you see in the market?

ZG: I think the market is going to be very active. I made a recent LinkedIn post which has over 30,000 views. Africa accounts for about 17.5–18% of the world’s population and about 2.73% of its GDP, but less than 1% of venture capital. So there’s a lot of catching up that needs to be done.

Even though we had a record-breaking year last year, there’s still a lot more that needs to be done from an investment perspective.

I’m very bullish, there’s going to be a lot more money I think coming into earlier stages, which is seed and Series A. And we’re going to have a lot more types of firms getting involved. There’s going to be more angel investing, even though we’re coming out of a tough year. With low interest rates in the US and Europe, there isn’t much of a channel for planning. So low interest rates are great from a financing perspective for founders, especially if you’re looking at debt financing but from an investment return perspective. I know people are saying that they’re going to raise rates in the US this year. But honestly, the trickle down into African VC is going to be so minor so I wouldn’t really worry too much about the effective interest rates going up. I’m very bullish on the amount of capital coming into Africa in the next two or three years.