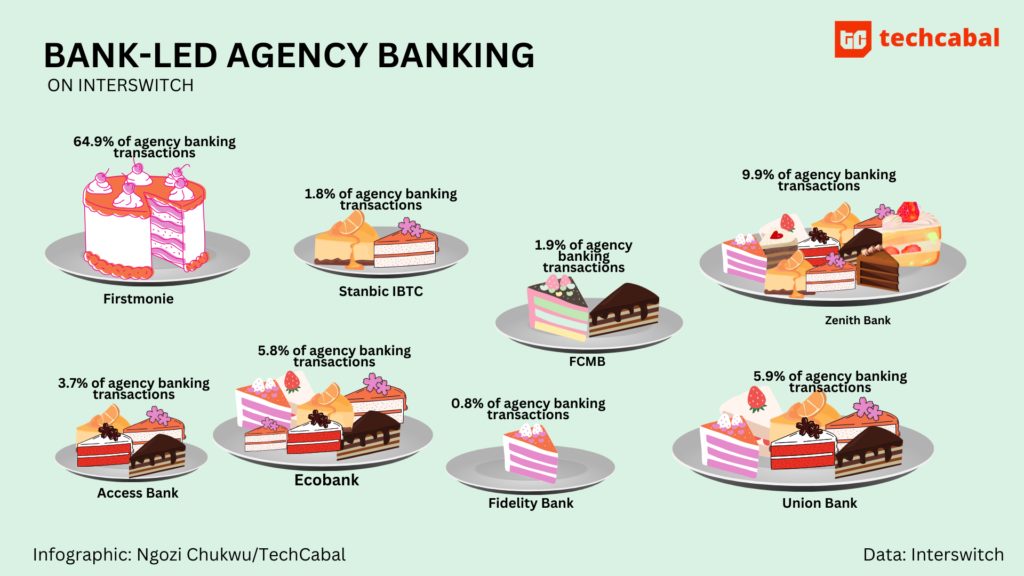

Firstmonie, the agency banking arm of First Bank of Nigeria, is the biggest bank-led agency player in the country’s agency banking market, according to data aggregated by payments provider Interswitch and seen by TechCabal.

Firstmonie processed over ₦1.1 trillion in transactions in 2023, more than double the amount handled by Access Bank, Zenith Stanbic IBTC, Union, Ecobank, FCMB, and Fidelity Bank combined.

The Interswitch report only reflects payment activity within its network and excludes information from Nigerian Inter-Bank Settlement System (NIBSS) which also processes a significant volume of payments.

The report shows that, compared to previous years, Firstmonie was outpaced by five VC-backed fintech companies—Moniepoint, Opay, MFS Africa (Onafriq), and Nomba. Previous Insterswitch reports show that from April 2021 to March 2022, Firstmonie processed the second-highest amount of agency banking payments—₦2 trillion, double what it processed in 2023.

Interswitch declined to comment on the figures.

Between 2021 and 2022, three bank-led agency banking services were in the top 10, but this new report shows them losing momentum and market share to fintech companies like Nomba, which processed ₦1.14 trillion—nearly 2.5 times what it did in 2021-2022.

One factor that may have contributed to the increased market share of agency banking players is the cash crunch in early 2023. As Nigeria grappled with widespread cash scarcity in 2023, traditional banks’ network infrastructure faltered under the weight of increased digital payments, leaving their various payment platforms, including POS agents, teetering. This operational nightmare was a golden opportunity for nimble fintech players whose platforms witnessed a surge in usage, including POS transactions.

The numbers speak for themselves. Paga, a long-time fintech player, processed a staggering ₦147.1 billion in transactions, more than double the ₦68.3 billion it handled through Interswitch’s platform between April 2021 and March 2022. This figure surpasses the transaction volume of the agency banking business of Access Bank, one of Nigeria’s biggest banks.

Industry analysts attribute this shift to several factors. Fintechs are perceived as more agile and adaptable, offering easier agent onboarding, a wider reach through mini POS terminals, and innovative solutions. Additionally, the 2023 cash crunch exposed limitations in traditional banking infrastructure, driving users towards alternative channels like agency banking, which fintechs were quicker to capitalize on.

More than being nimble, these fintechs are also more accessible than bank-led agency banking providers. While Firstmonie still boasts the largest bank-led agent network in Nigeria with over 200,000 agents, which it claims are “spread across 772 out of 774 local government areas in Nigeria,” it has stricter agent requirements that exclude a larger part of the small and medium businesses.

To become a Firstmonie agent, you must have an existing business registered with a corporate body or a current account. This excludes a lot of legitimate small businesses and even individuals who want to make a business of the POS agency by itself. Fintech competitors like Moniepoint and Opay only require means of personal identification.

“Amongst fintech themselves, there is cutthroat competition because this is all they have to survive on,” an agency banking expert told TechCabal.

“Banks have many other options. They make money from loans, transfers, and more.” However, fintech has to come up with ways to survive or die. Last year saw the exit of agency banking services like Kippa Pay. The Interswitch report shows that the fintech processed only ₦36 million in 2023 before it closed shop due to the decreasing margins in the business.

It is also plausible that fintech companies like Opay and Moniepoint, which have raised funding, can use VC funds to subsidise their products and services to gain market share. Firstmonie, for instance, reportedly has a higher charge on transactions than fintechs. VC funds also make fintech quicker on their feet than banks. While banks may need to wade through bureaucracy to make capital investments in hardware like the much cheaper mini POSes, fintechs like Nomba and Opay have been aggressively pushing to widen and deepen the reach of their services.

However, there may be a shift in dynamics in favour of the banks shortly, considering how inflation is driving up the cost of POS devices and shrinking margins. Seeing that VC funding is less forthcoming, this fintech may give way to banks that already have sustainable businesses that can feed the growth of their agency banking arm.